Pet ownership comes with a unique set of joys and responsibilities, and one of the most important can be ensuring our furry friends receive proper medical care. As veterinary costs continue to rise, many pet owners are exploring different financial strategies to manage these expenses. Three popular options are pet insurance, vet telehealth, and discount programs. Each comes with its own set of advantages and disadvantages, and the best choice for you will depend on your pet's specific needs and your budget. This can include choosing one option, or stacking a couple of different options like telehealth and pet insurance!

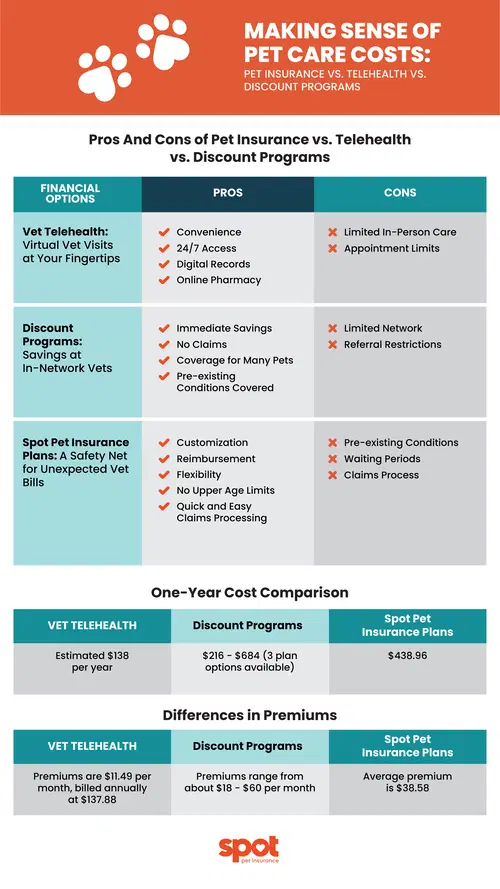

Vet Telehealth: Virtual Vet Visits at Your Fingertips

Vet telehealth services offer virtual consultations with licensed veterinarians or veterinary experts typically through phone or video calls.

Pros:

Convenience: Get veterinary advice from the comfort of your home.

24/7 Access: Many telehealth services offer unlimited chats with veterinary professionals.

Digital Records: Some may offer the ability to easily store and access your pet's medical records online.

Online Pharmacy: Some platforms offer an integrated online pharmacy.

Cons:

Limited In-Person Care: Telehealth doesn't replace the need for in-person veterinary care for physical exams, vaccinations, and certain treatments.

Appointment Limits: Some services limit the number of video appointments per year.

Discount Programs: Savings at In-Network Vets

Discount programs offer reduced rates on veterinary services at specific clinics within their network.

Pros:

Immediate Savings: You'll see the discount applied to your bill at the time of service.

No Claims: There's no need to submit claims for reimbursement.

Coverage for Many Pets: Many programs can cover dogs, cats, birds, and exotic animals.

Pre-existing Conditions Covered: Unlike insurance, coverage for pre-existing conditions are often eligible for discounts.

Cons:

Limited Network: You're restricted to using veterinarians within the program's network, which may be small.

Referral Restrictions: Referrals to specialists outside the network may not be covered.

Spot Pet Insurance Plans: A Safety Net for Unexpected Vet Bills

With a Spot plan, you pay a monthly or annual premium, and in return, a percentage of your pet's eligible veterinary expenses can be covered.

Pros:

Customization: You can choose between accident-only or comprehensive accident and illness plan options. You can also add on optional coverage for preventative care.

Reimbursement: Policies can reimburse up to 90% of eligible vet bills and can help provide substantial financial relief.

Flexibility: You can visit any licensed veterinarian in the US or Canada.

24/7 Support: You will have round-the-clock access to veterinary experts via our 24/7 Pet Telehealth Helpline.

No Upper Age Limits: Spot Pet Insurance plans have no upper age limits, so they will never age out of coverage. You can enroll your pet as young as 8 weeks.

Quick and Easy Claims Processing: Submit your claim through your member portal online or via our app, and receive your reimbursement for covered claims through check or direct deposit. (You pick!)

Cons:

Pre-existing Conditions: Pet insurance typically doesn't cover pre-existing conditions, but with Spot, if a condition is curable,and has been treatment and symptom free for a period of 180 days, it can be eligible for coverage under your Spot policy. This excludes knee and ligament conditions.

Waiting Periods: Spot plans typically have a 14-day waiting period before coverage kicks in for unexpected illnesses and accidents. Policyholders in certain states may be eligible for next-day coverage for accidents. Get a quote to learn more about waiting periods in your state.

Claims Process: You'll need to pay the vet upfront and then submit a claim for reimbursement.

Additional Considerations

Differences in Premiums:

Discount program premiums can range from about $18 - $60 per month, depending on the plan selected.4

Telehealth premiums are typically around $11.49 per month, billed annually at $137.88.5

Spot Pet Insurance average premium is $38.58.1

One-Year Cost Comparison:

Discount Program: $216 - $684 (3 plan options available)4

Spot Pet Insurance: $438.961

Vet Telehealth: Estimated $138 per year5

Example Case Scenario:

After a year of paying for a pet care service, your dog injures their cranial cruciate ligament. According to Spot’s internal data the average cost of treatment for a cranial cruciate ligament injury is $1,586.50.2

Coverage with Spot Pet Insurance (90% reimbursement): $1,427.853

Savings with a Discount Program (25% reimbursement): $396.504

Savings with a Telehealth subscription: $0

Choosing the Right Option for Your Pet

One of the best ways to determine which option is right for you is to carefully consider your pet's age, breed, health status, and your budget. Pet insurance may be ideal if you're concerned about unexpected veterinary expenses, while vet telehealth can be a convenient option for routine consultations and minor issues. Keep in mind that telehealth does not replace the need for in-person veterinary care for your vet. Discount programs can offer significant savings if you're comfortable using a limited network of vets. It is important to note that you do not need to choose between telehealth and pet insurance. You could use telehealth in conjunction with your coverage!

With 10 years of experience as a pet parent, I aim to empower pet owners with insights into pet insurance and maintaining their pet's well-being. I aspire to be a trusted source, combining knowledge with a commitment to the welfare of our beloved pets.

1 – Average premium of Spot policyholders with a 90% reimbursement rate, $500 annual deductible, and $5000 annual limit. Annual premium is the monthly cost over 12 months less the $2 monthly transaction fee. Plan costs vary. Individual results may differ.

2 - Jan 2019 to Aug 2024 administrator claims data.

3 – Reimbursement assumes that the annual deductible has already been met, annual limit has not been satisfied, and the entire treatment plan is eligible for 90% cash back coverage.

4 - “Pet Wellness That’s Refreshingly Easy.” Pet Wellness Plans | Affordable Healthcare Coverage for Routine Veterinary Services, www.petassure.com/mint-wellness-plan/.

5 - “Vetster Plus - One Subscription to Manage Your Pet’s Health - Vetster.” Vetster Online Vets, Vetster Online Vets, vetster.com/en-us/plus.